Pink tax – an additional expense for women

Whenever it comes to equality between men and women, stories surrounding recruitment regimes, income, and job opportunities are regularly put on the table. However, few people know that taxes, which appear to be fair to all genders, are the cause of woman spending more on the same products as men. That is due to the presence of a tax that bears the name "Pink tax."

"An obligation" when you are female

Although referred to as a "tax", the pink tax does not appear officially in law nor clearly regulated by governments like other taxes. The term "pink tax" was born because pink is a color that is commonly associated with women (products and items for women tend to use pink in designs and packaging) (according to NOI Cooperative). When combined with "tax," pink tax refers to the absurd additional cost that women have to pay for products specifically for women, in compare with equivalent products for men. Simply put, the pink tax is the cost difference between products and services marketed to women versus men.

According to a study by the New York Consumer Advisory Agency (CDCA of 800 product categories in 2015, women pay more for most products over their lifetime, from children’s clothing to health care items. For example, women's clothing is 8% more expensive than men's, health care products for women are about 13% more expensive than men's, and toys for girls are 7% more expensive than boy’s. For the similar razor product, women have to pay $5.39 while men only have to pay $4.99.

The pink tax does not only apply to common items; it is also adapted in the cost of products that are essential to women, such as sanitary napkins, menstrual cups, etc.

Although 2 products have the same amount and shape, just differences in colors, women still have to pay a higher price (Source: Dep Magazine)

When did pink tax appear?

It is frequently consumed that the pink tax has recently gained people's attention, however, the pink tax has been present since early research on consumption in the US. In 1994, a report from the state of California, USA, stated that 64% of stores in different cities charged extra fees when washing and steaming women's shirts, proving that the pink tax phenomenon has existed at least since the 1990s. Nevertheless, at that time, the phrase "gender tax" was used more popularly instead of the pink tax. After about two decades, in 2015, the pink tax drew more public attention than ever before when California Democratic Representative Jackie Speier introduced the Pink Tax Repeal Act. The wave of support from women for the mentioned Act became stronger than ever.

The impact of the pink tax on "the other half of the world"

The effects of the pink tax on women will inevitably reduce women's purchasing power. When prices are high, women must spend more on the products they use. Consequently, as men and women receive the same amount of salary, women would buy less products than men, which resulting in a decrease in women's purchasing power. This downtrend would cause women to be labeled as " meticulous and scrupulous" even though the cause does not really come from their side.

In addition, according to the World Economic Forum, the pink tax also puts a financial burden on the "other half". In particular, in the context that the equality of wages between men and women is still questionable, the pink tax makes the gap in salaries of the 2 sexes increases even more. In the context of Vietnam, specific research on pink tax has not been conducted. However, the UN Women report on Gender Equality and Taxation in Vietnam (2016) has pointed out that there was an enormous divergence in income between men and women. Nevertheless, the paradox which appears is that women, despite gaining lower incomes in average, receive less consumption tax incentives. Moreover, the value-added tax often applies on their essential goods. For instance, tampons and sanitary napkin products are still subject to import tax ranging from 15 to 22.5 percent and a VAT tax of 8 percent though these are products that women are required to consume every month. For men, they would never have to pay for them during lifetime.

Several ways to avoid the "pink tax"

Although it is an "unofficial" tax, this unreasonable expenditure is common in a wide range of product and service categories since there is no official legislation addressing the issue. However, there are still a few effective methods that will help you be more aware of the appearance of "pink tax".

Firstly, for products that are comparable between sexes or have little difference in functionality, consider purchasing a product that is less expensive while still providing similar quality.

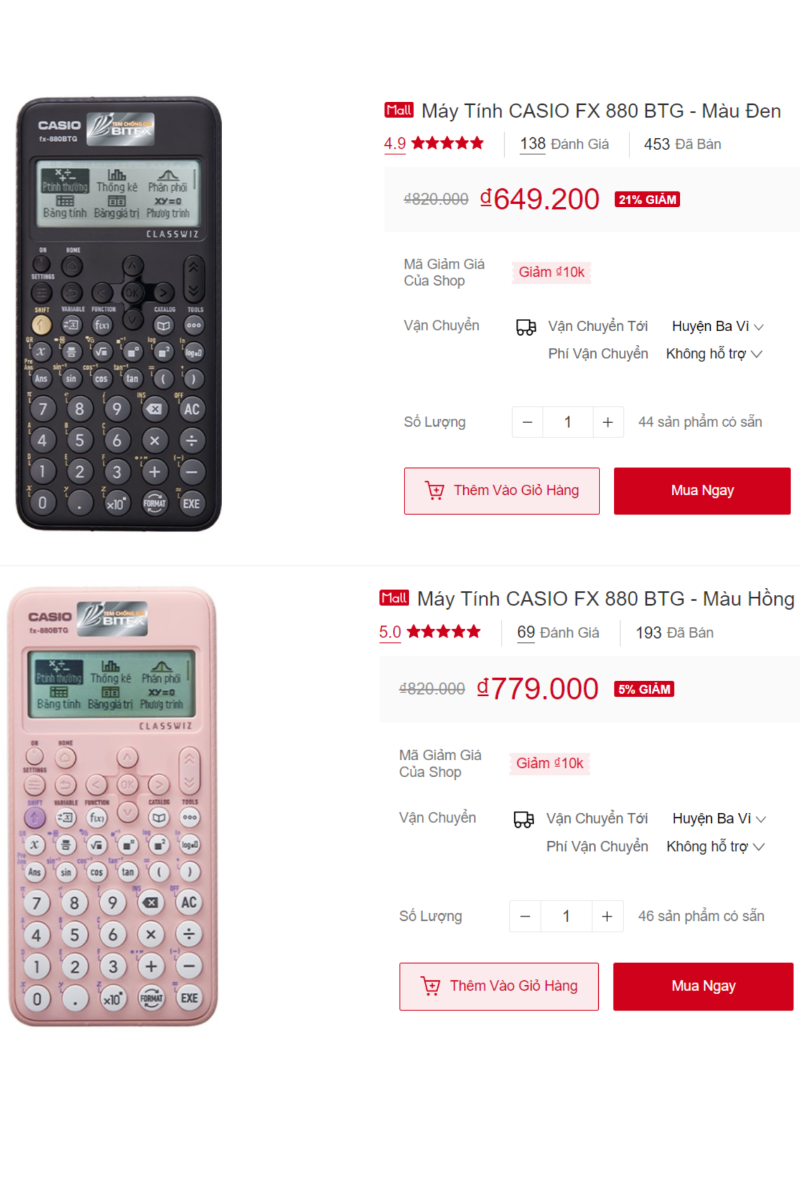

Buying a black calculator with equivalent features instead of pink at a higher price (Source: Shopee e-commerce platform)

After that, when shopping for clothes, carefully observe and examine the price difference between stores and brands, determining which stores and brands are charging higher prices for women's products. This will definitely give a hand in helping you realize and consume more rationally, resulting in lower-cost purchases.

Finally, pick products that are sustainable. Because of their long-term reusability, sustainable products require less money to use. Especially for UEHers, using sustainable products has never been easier. UEH's souvenir products always promote sustainability and come in neutral colors that are appropriate for both genders.

In conclusion, the "pink tax" has been and will always be a part of our lives, even if it is a hidden expense resulting from societal prejudice. Through this sharing, it is hoped that UEHers will gain more awareness and be able to actively seek ways to limit their spending on the "pink tax". Furthermore, UEHers can also share this knowledge with their friends to help raise awareness about the "pink tax".

News and photos: Department of Student Affairs

![[Podcast] Latest approaches for sustainable universities](https://en.ueh.edu.vn/images/upload/thumbnail/ueh-thumbnail-042022-071224.png)