Special Doctoral Session - Special session before the 4th Asia Conference on Business and Economic Studies (ACBES 2022)

05 Sep, 2022

With the aim of creating opportunities for Ph.D. students to exchange with European leading professors related to Research Methods and international publication, on August 29th, 2022, special editions for Ph.D. candidates were held. Special Doctoral Session - A special session before the 4th Asia Conference on Business and Economic Studies (ACBES 2022) with the moderation of Prof. Gabriel S. Lee (University of Regensburg, Germany) attracted 110 customers to attend.

The Asia Conference on Business and Economic Studies 2022 ACBES was held from August 29th, 2022 to August 31st, 2022, in which, on the morning of August 29th, 2022, a special session for PhD students and researchers was held. Young researchers (Special Doctoral Session) under the moderation of Prof. Gabriel S. Lee. A special session before the conference with the participation of young scholars from more than 10 countries listed as Malaysia, Philippines, India, and countries in the area, including 50 in-person attendees and 60 online participants. Although this is a special session for Ph.D. students, many visitors from the ACBES Conference attended early.

Prof. Gabriel S. Lee graduated in mathematics and economics from the University of Alberta with a Master’s degree in economics from the University of Western Ontario. After that, he earned a Doctorate in economics from the University of Chicago with the topic “Housing Investment under Time to Build and Adjustment Costs”. Before officially joining the University of Regensburg, Germany, he held various positions at the University of Pittsburgh, the University of California, Davis, the Universities of Vienna and Innsbruck, and the Institute for Advanced Study in Vienna. Prof. Gabriel S. Lee has become a Professor of real estate economics since April 2004 at the University of Regensburg. The main research of Prof. Gabriel S. Lee focuses on real estate economics in macroeconomics.

During the special session, Prof. Gabriel S. Lee suggested some points of interest to complete a presentation, and some recommendations for a published research. According to Prof. Gabriel, to write an article for publication, the author needs to write more concisely than writing a full long essay, using 2-3 keywords used in the article and using it right in the title of the article, avoid titles that are too general and do not convey the meaning clearly.

Prof. Gabriel S. Lee suggested some notes for abstracts, focusing on writing abstracts in the 100-150 word range, conveying an important and novel contribution, besides in-text citations and writing results that are being studied. Especially, Prof. Gabriel S. Lee drew on academic experience and made important points in writing articles in accordance with international standards.

Prof. Gabriel S. Lee at the Special Doctoral Session for Fellows and Young Researchers

After the presentation of Prof. Gabriel S. Lee were the presentations of fellows with diverse topics listed as finance, banking, development economics and so on, respectively.

With the presentation of Ph.D. Candidate Pham Thi Thuy Diem (Banking University of Ho Chi Minh City, and University of Economics Ho Chi Minh City, Vietnam) on the topic “Investigating the Impact of Financial Development on Economic Growth in Developing Countries using a Bayesian Model Averaging Approach. The article studies on 64 countries in the period 2003–2017, through the research results, it can be seen that the investment in the share of domestic product (GDP) and foreign direct investment have a positive impact on economic growth; on the contrary, population growth has a negative effect on economic growth.

PhD Candidate Pham Thi Thuy Diem presenting her research paper

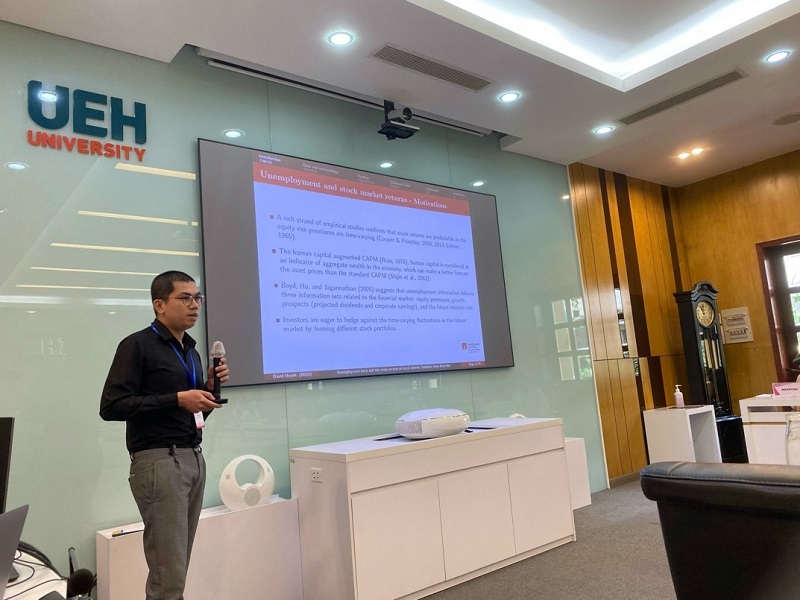

Next, PhD Candidate Nhan Huynh (Macquarie University, Australia) presented a research paper on “Unemployment Beta and the Cross-Section of Stock Returns: Evidence from Australia” PhD Candidate Nhan Huynh analyzed the impact of unemployment indicators (including: predicted unemployment rate and actual unemployment gap) on cross-return in the Australian market. The research showed that stocks in the lowest unemployment test period produce higher and risk-adjusted returns than in the high unemployment test period. The predictability of unemployment is significant at 36 months for aggregate returns and 24 months for cross returns. Furthermore, unemployment insurance costs are positively correlated with economic, financial, and political instability.

Presentation by Ph.D. Candidate Nhan Huynh

For research by Ph.D. Candidate Tran Thanh Truc (University of Economics Ho Chi Minh City, Vietnam) on the topic “Vietnam in Transition: The Nexus of Institutions, Entrepreneurship, and Economic Growth”. The paper used the GMM 3SLS method for panel data in Vietnam. The results showed that there is a positive relationship between institutions and business start-ups, some policies listed as: Supporting businesses, supporting labor having a significant impact on business establishment. Moreover, the study showed that institutions have an indirect impact on economic growth through enterprises.

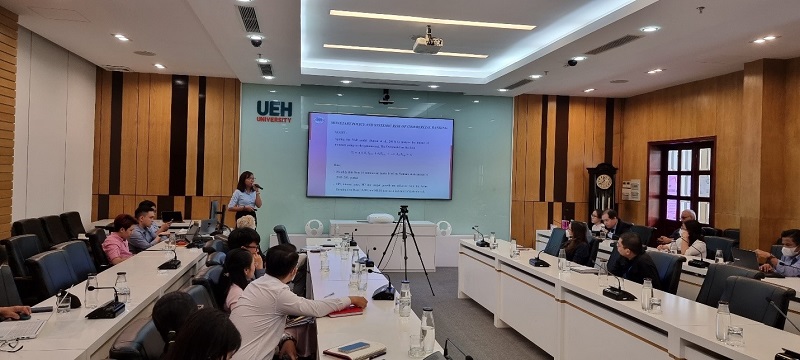

The topic “Monetary Policy and System Risk of Vietnamese Commercial Banks” was researched by Ph.D. Candidate Nguyen Thi Thanh Hoai (University of Economics Ho Chi Minh City, Vietnam) for the period 2013–2021 based on 18 commercial banks listed on Vietnam's stock market. The paper used a VAR model with variables: Monetary policy, systematic risk, CPI and output gap. Research results indicate that systemic risk increases during the COVID-19 period. The results did not find evidence of statistical significance on the impacts of monetary policy on the systemic risk of commercial banks. However, the study found statistically significant evidence on the impacts of systemic risk of commercial banks on CPI and output gap during the pandemic. Therefore, to cope with the COVID-19 pandemic, governments need to implement fiscal policy which is necessary to ensure the stability of the banking system and the economy during the pandemic period.

Researcher Nguyen Thi Thanh Hoai presenting her research paper

At the special session, the Ph.D. candidates both presented their own research topic and had opportunities to receive more useful comments from Prof. Gabriel S. Lee. Besides, the discussion questions and exchanges of young researchers participating can contribute more creative ideas to develop the research paper.

Additional photos relating to the Special Doctoral Session:

The scientists discussing enthusiastically with Prof. Gabriel S. Lee in the Special Doctoral Session

The photos commemorating the end of the Special Doctoral Session

Further information:

All JABES new information and outstanding events listed as ACBES International Scientific Conference, JST Talk series and other events will be continuously updated on JABES official channels as follows:

- JABES Facebook: https://www.facebook.com/jabes.ueh.edu.vn

- JABES Website: http://www.jabes.ueh.edu.vn/

- JABES on Emerald Group Publishing: https://www.emeraldgrouppublishing.com/journal/jabes

- ACBES Website: https://acbes.ueh.edu.vn/

- JABES Youtube: http://shorturl.at/jnoOR

News, photos: JABES

![[UEH 50 Years] UEH Launches Program of 50+ Inspiring Glo-cal Classes, Connecting with Practical Experts](/images/upload/thumbnail/ueh-thumbnail-639084107891803708.png)

![[Research Contribution] Modernizing and Elevating Vietnamese Higher Education: Creating Breakthroughs in High-Caliber Human Resource Development and Talent Cultivation, Leading Research and Innovation](/images/upload/thumbnail/ueh-thumbnail-639083193174001549.png)

![[Research Contribution] Sustainable Manufacturing: A Driving Force for the Green Economy and the Challenges Ahead](/images/upload/thumbnail/ueh-thumbnail-639082294182922007.png)