CELG Seminar Topic 1: “Uncertainty and Corporate Default Risk: Novel Evidence from Emerging Markets”

05 Jun, 2022

On the morning of May 26th, the periodic extracurricular activity series of UEH College of Economics, Law, and Government (CELG) with topic 1: “Uncertainty and Corporate Default Risk: Novel Evidence from Emerging Markets” took place officially in Room B1-1001.

A dynamic research environment is a strong background and launching pad for academic and applied researchers. UEH College of Economics, Law and Government (CELG) always focuses on building a diverse research ecosystem. Therefore, the launch of the CELG Seminar (CELGS) aims to develop scientific research capacity, contribute to creating academic values, increase the quantity and quality of academic research, diversify research topics within the internal school; at the same time, creating a communication environment and expand relationships with domestic and international researchers. CELG Seminar has periodically held meetings 2 times/ month with the participation of popular researchers who are academically reputable to join hands to contribute to the development of a sustainable academic community.

The first scientific meeting of CELGS recorded the participation of Dr. Pham Khanh Nam - Deputy Head of CELG, Assoc. Prof. Dr. Vo Tat Thang - Director of Health and Agricultural Policy Research Institute, CELG Lecturers, and the UEH School’s internal and external researchers.

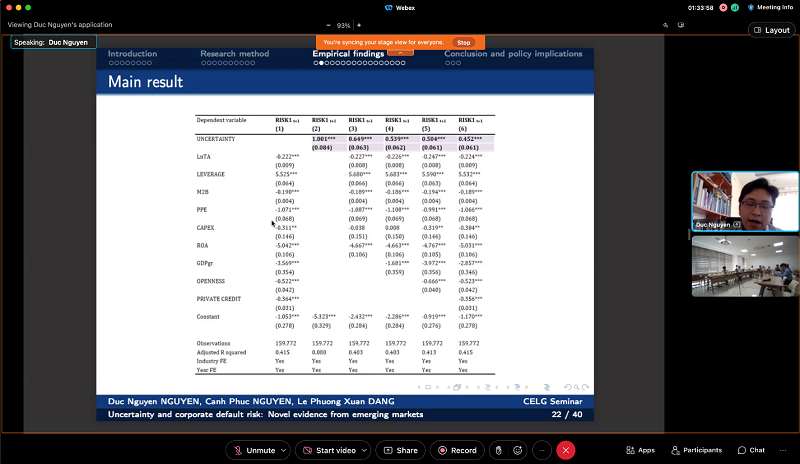

Dr. Nguyen Phuc Canh - Lecturer of UEH School of Banking and Dr. Nguyen Duc Nguyen - Lecturer of Da Lat University brought to lecturers and researchers attending CELGS a potentially exploitable new research topic: “Uncertainty and Corporate Default Risk: Novel Evidence From Emerging Markets”. This research mentioned a new approaching methodology by measuring and searching channels affecting the uncertainty of a nation and the default risk of corporates in newly popular markets in the 1991-2019 period. The research result revealed that the uncertainty positively correlates to default risk and this impact tends to be greater for the most careful and ready-to-accept-risk corporates. This research also discovered that this uncertainty also correlates positively to the risk-taking behaviours of corporates and the cost of debt and negatively to cash holdings and financial performance. Additionally, the research pointed out that uncertainty has little effect on default risk on large corporates and those listed on developed stock markets.

The research topic of Dr. Nguyen Phuc Canh and Dr. Nguyen Duc Nguyen attracted the concern of delegates and participating guests. Discussion activities raised issues required to be conducted and solved in the future.

Dr. Nguyen Phuc Canh was presenting his research

Dr. Nguyen Duc Nguyen presenting and discussing online on the platform of Webex

Dr. Pham Khanh Nam hosting CELG Seminar

CELG Seminar with the first theme “Uncertainty and Corporate Default Risk: Novel Evidence from Emerging Markets” took place successfully and brought new aspects as well as intensive and useful research knowledge for the delegates and participating guests. Besides, lots of experiences of research activities and their publications were shared to promote better research activities and international publications and expand the knowledge of the Vietnamese on the world map.

CELG Seminar topic 2 is scheduled to be held in June this 2022. UEH does hope to receive the concern and participation of researchers.

News, photos: CELG General Department, Department of Marketing and Communication

![[Contribution Research] How Ho Chi Minh City students’ green product consumption is affected by application iCTs innovation nowadays: A case for business to enhance green product consumption by understanding the role of environmental concerns, green consumption value and perceived effectiveness](/images/upload/thumbnail/ueh-thumbnail-639044087939815424.png)

![[Research Contribution] Determinants impacting young consumers purchasing behavioral intention on sustainable fashion: exploration in Ho Chi Minh City](/images/upload/thumbnail/ueh-thumbnail-639035712273480983.png)

![[Research Contribution] What influences UEH students’ attitudes toward the “UEH Zero Waste Campus” project](/images/upload/thumbnail/ueh-thumbnail-639033816949877456.png)