Application of Artificial Intelligence Technology in Financial Services in Vietnam – Part 1: AI Technology Trends

29 Aug, 2022

Artificial intelligence (AI) technology is increasingly being adopted globally and is absolutely bringing in the core changes in a number of industries, including financial services. In this development trend, in Vietnam, the application of AI technology in the fields of asset management, risk management and financial advisory services is being rather limited. In part 1 of this research paper, the authors will provide an overview of the most popular trends and AI technologies used in asset management, risk management and financial advice today.

Machine Learning (ML) – The most popular AI approach until the current time

While AI is a vast field with many approaches developed over time, the recent interest in AI has been almost entirely focused on machine learning (ML) techniques and has been the most popular AI approach up to the current time. Machine Learning – ML is concerned with using data to incrementally tune the parameters of statistical, probabilistic, and other computational models. Essentially, ML automates one or more stages of information processing to produce a final model for forecasting or classification. Most ML applications in property management, and even in management in general, are based on a few key techniques. The main characteristics of the popular machine learning techniques used in the financial sector are shown in Table 1.

|

Artifical Neural Network |

|

|

Random forest |

|

|

Support Vector Machine |

|

|

Cluster Analysis |

|

|

Evolutionary algorithm |

|

|

LASSO algorithm |

|

|

Natural Language Processing |

|

Table 1: Key characteristics of popular machine learning techniques used in the financial sector. Source: Author

The current status of AI technology application in the financial sector in Vietnam

In Vietnam, AI technology has been widely applied in the financial industry, which manifests as more and more FinTech businesses are born.

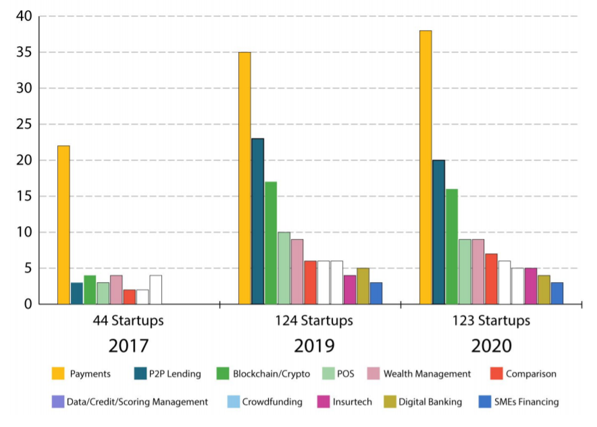

Figure 1: The number of Fintech startups by sector within 2017-2020. Source: fintechnews.sg

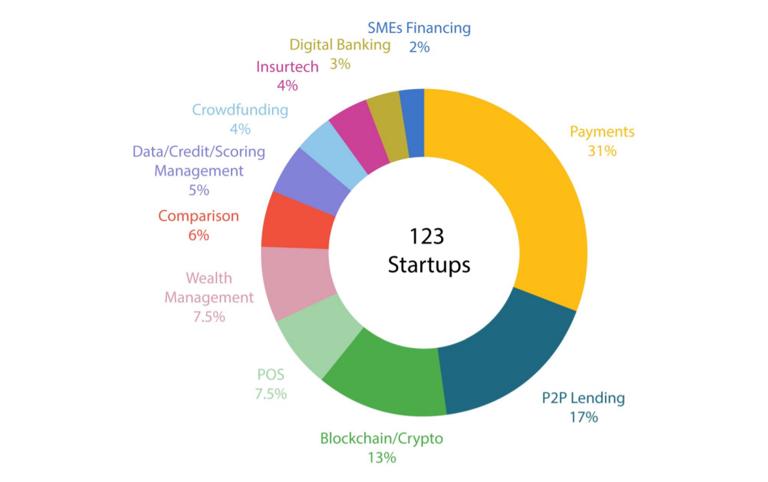

The significant increase in Fintech businesses demonstrates the potential of applying technology to solve problems and issues in the financial sector. However, the growth of Fintech companies in the period 2015-2020 shows that the growth mainly focuses on a few areas (payments, lending) and ignores some very potential areas and important role in the financial industry (investment, asset management, risk management). In accordance with a report conducted by Fintechnews.sg on the Fintech sector in Vietnam, the payment, lending and blockchain sectors account for more than 60% of Fintech businesses. Meanwhile, the number of Fintech enterprises in the field of asset management, credit rating/rating accounts for less than 13% (Figure 2). Part of the reason may lie in the fact that the core technology required in the fields of asset management, risk management or financial investment requires complex technologies and requires a lot of human and financial cost resources to develop, rather than technologies in the areas of P2P payment or lending.

Figure 2: Distribution of Fintech enterprises by sector in 2020 in Vietnam. Source: fintechnews.sg

Solutions for AI technology application in the field of financial services in Vietnam today

* Portfolio Management

AI techniques can be used to perform fundamental analysis that requires the combination of multiple sources of information, including the use of text analytics, and to optimize attribution assets in financial portfolios. Compared to conventional portfolio optimization methods, AI techniques often provide better estimates of return and variance. These estimates can be used to optimize traditional portfolios. Furthermore, AI can be used directly for asset allocation decisions to build portfolios that meet performance goals more closely than portfolios generated using traditional methods.

Methods to build portfolio include: NLP, LASSO Regression, Artificial neural network (ANN), SVM.

Portfolio Optimization Method: Artificial neural network (ANN) techniques can be trained to make asset allocation decisions under complex constraints that are often not easy to integrate into returns expectation – variance.

* Financial risk management

AI techniques also have applications in risk management, involving both market risk and credit risk. Market risk refers to the possibility of loss due to common market influences, and credit (or counterparty) risk is the risk that a counterparty will not fulfill its contractual obligations.

One application of AI in market risk management involves extracting information from textual or visual qualitative data sources. Or unsupervised AI methods can be used to detect anomalies in the risk model’s forecast outputs by evaluating all the forecasts generated by the model and automatically identify any anomalies. Risk managers can also use supervised AI techniques to generate benchmark forecasts for model validation. Comparing model results and forecasting standards will reveal whether the risk model is generating predictions that are significantly different from those generated by AI. AI techniques that can also predict market volatility and financial crises, especially ANNs and SVMs, are capable of capturing nonlinear relationships that give them an advantage over natural model regression with conditional variance (GARCH). ANN and SVM techniques are also widely applied in credit risk management today.

* Financial consulting by automated robot technology

Robot-advisors are computer programs that provide financial advice to assist individual investors in their investment activities. Advisor-robots are gaining considerable attention recently because of their success in reducing entry barriers for amateur investors. Robotic advisors can integrate all kinds of AI applications into portfolio management, trading and portfolio risk management. By embracing the success of AI in these areas, robot-advisors can not only create portfolios with better out-of-sample performance for investors but also can automatically rebalance the portfolio, automatically managing the risk of the portfolio and minimizing transaction costs.

Institutional investors can also benefit from robot advisors’ ability to process a wide range of financial data. Although reducing behavioral biases when making investment decisions is beneficial for all types of investors, non-specialist investors especially benefit from robotic advice in terms of raising capital portfolio performance, increasing diversification and reducing risk.

Please refer to the full research APPLICATION OF ARTIFICIAL INTELLIGENCE TECHNOLOGY IN FINANCIAL SERVICES IN VIETNAM here. Author group: Dr. Ngô Minh Vũ, Dr. Nguyễn Hữu Huân – Faculty of Banking, UEH School of Business.

This writing is in series of spreading research and applied knowledge from UEH with “Research Contribution For All – Nghiên Cứu Vì Cộng Đồng” message, UEH would like to invite dear readers to follow Newsletter ECONOMY NO. #56 “Application of Artificial Intelligence Technology in Financial Services in Vietnam – Part 2: Recommendations for policy”.

News, photos: Author group, UEH Department of Marketing – Communication

![[UEH 50 Years] UEH Launches Program of 50+ Inspiring Glo-cal Classes, Connecting with Practical Experts](/images/upload/thumbnail/ueh-thumbnail-639084107891803708.png)

![[Research Contribution] Modernizing and Elevating Vietnamese Higher Education: Creating Breakthroughs in High-Caliber Human Resource Development and Talent Cultivation, Leading Research and Innovation](/images/upload/thumbnail/ueh-thumbnail-639083193174001549.png)

![[Research Contribution] Sustainable Manufacturing: A Driving Force for the Green Economy and the Challenges Ahead](/images/upload/thumbnail/ueh-thumbnail-639082294182922007.png)