Workshop by School of Finance: “Digital technology in funding for real estate projects”

04 Nov, 2021

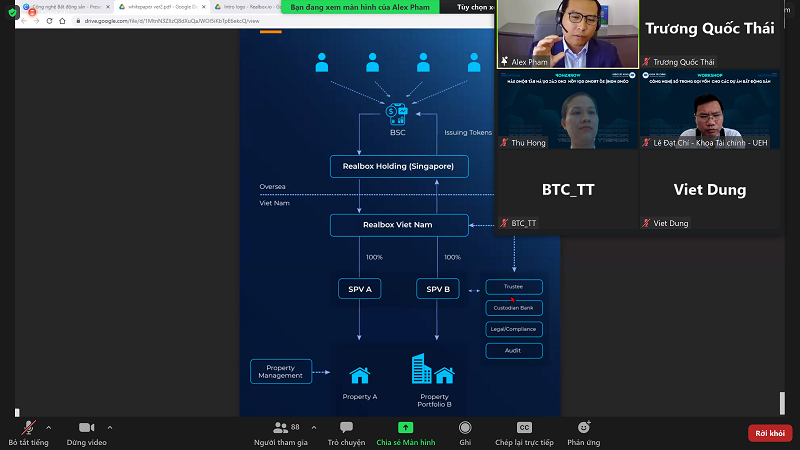

Following Financial technology (Fintech) trend, in general, and Property technology (Proptech), in particular, on November 2nd morning, UEH - School of Finance collaborated with Sai Gon Dau Tu Tai Chinh Journal (Sai Gon Giai Phong Newspaper) to organize “Digital technology in funding for real estate projects” workshop, with the participation from experts, lecturers and business representatives.

At the workshop, the speakers presented and discussed excitingly many topics related to new investment and capital mobilization forms, as well as legal framework issues and risk management of enterprises and investors in the real estate field, on the basis of blockchain technology application.

From experts’ points of view, real estate is a greatly valued asset and an interesting investment channel; consequently, only financially capable investors have the opportunity to be involved. Therefore, "slicing" real estate values into "small pieces" so that everyone can participate in investing through widely concerning technology applications. The involvement of many people in one market creates transparency, jointly controlling the investment process, switching from a centralization propensity to decentralization propensity to limit the present Covid-19 context.

Dr. Dinh Thi Thu Hong - Head of UEH - School of Finance shared: “Calling for capital for real estate projects through digital technology is an innovative business model. Recently, Vietnam has not had any legal regulations for real estate project funding, which uses technology applications (blockchain or crowd-funding). However, investment demands in Financial technology (Fintech), more specifically Property technology (Proptech), with the form of Blockchain real estate investment, is completely focused.”

Dr. Phan Phuong Nam - Deputy Dean of Commercial Law Faculty, Ho Chi Minh City

University of Law affirmed that, currently, there have been a number of units deploying capital mobilization via token technology with 3 main modalities: business cooperation contracts, business co-owners; real estate investment funds.

Regarding Token technology, MBA. Nguyen Trieu Dong – UEH Lecturer shared that Tokenization is a natural evolutionary step of securitization, creating opportunities for real information transparency, blockchain technology-based transactions and so on. Investors only need to have a little capital to take part in real estate investment. This investment model transaction mechanism is very flexible, fast and needless to be based on smart contract intermediaries. As a result, it will reduce costs, minimize administrative procedures transferring real estate ownership, etc.

In addition to the positive inclinations, a variety of perspectives at the workshop also posed this model’s legal situations. In fact, this term has just been formed in Vietnamese market with neither transparent legal corridor nor legal framework for digitalized real estate business and so on; therefore, when risks and disputes occur, there is no idea how to handle or whether it would be legally recognized.

Prof. Dr. Tran Ngoc Tho - Member of National Financial and Monetary Policy Advisory Council - emphasized that controlling international payment activity risks of banks is extremely vital. The control is based on the way of doing business, observing what benefits this investment brings to society and everyone as well as inclusive finance, apart from that of investors. The important thing is, when it is born, how we control and handle risk incidents, especially tax evasion and money laundering problems.

“When a new investment form or technol

ogy product appears, the authorities will initially impose this issue in order to optimize technology benefits while minimizing risks. More than that, in international payments, financial leverage standards, anti-money laundering, anti-terrorism, cyber safety assurance and a series of matters are also raised so as to protect parties’ interests; don't let an extraordinarily valued activity be unreasonably blocked”, affirmed by Prof. Dr. Tran Ngoc Tho.

Experts’ sharing during the seminar:

Experts’ sharing during the seminar:

To solve this investment model’s challenges, research team including Assoc. Prof. Dr. Phung Duc Nam, MBA. Nguyen Trieu Dong, MBA. Nguyen Tri Minh, MBA. Tran Hoai Nam, MBA. Tran Nguyen Dan, MBA. Truong Trung Tai from UEH School of Finance recommended the following resolutions:

1st: A sandbox mechanism (pilot) to develop the real estate tokenization market: It is necessary to have a tax and procedural incentive mechanism to generate a driving force to promote the real assets-digitized market.

2nd: Government needs to complete the regulatory framework for digital assets soon so that people can feel secure when investing in new areas.

3rd: A digital currency system, in the future, will be required to harmonize and develop together with digital asset field.

4th: It is essential to connect with the world markets to increase market liquidity and efficiency in real asset exploitation helping promote the real economy.

5th: Higher transparency in terms of real estate planning, disputes, or transaction restriction information is demanded. This kind of information can be online so that citizens can easily look up and learn about properties before investing.

To sum up, "Digital technology in funding for real estate projects" workshop was held successfully with full participation and mdiscussion from experts, lecturers, and businesses’ representatives who analyzed and offered useful solutions towards the development of digital technology application in real estate sector. Simultaneously, this is a testament to the efforts of School of Finance, in particular, and of UEH, in general, towards the goal of commonly connecting, spreading knowledge, steadily thriving and contributing to the sustainable development of the society and the community.

News, Photos: Department of Marketing and Communication