Scientific Conference: What is the next monetary system?

14 Jun, 2021

The history of the global monetary system is constantly changing when the current system causes economic chaos within it. A global monetary system can be durable, but not permanent. Over time, as the worldwide center of power shifts and as knots and imperfections in the system grow to unsustainable levels, it will increase disorder levels, a system being gradually or suddenly rearranged or replaced into another system.

Outline the next monetary system

What the next monetary system will look like is an open question. There are already many proposals for this alternative. Whatever form it takes, it won't be fully tied to any single country's currency, as no country is big enough for that.

Some current proposals can be mentioned: Decentralized energy pricing; global digital Bancor; Bancor digital area; gold standard; Bitcoins as reserve assets…

The question is, will the US abandon the current system to adjust itself to a new one?

Blockchain technology creates new options for decentralized international payments linked to a specific fiat currency or a basket of fiat currencies calculated according to a specific algorithm.

It is software applied to the global banking system, which is relatively outdated; potentially a much more liquid means of transaction.

In 2020, the largest commodity companies globally, such as BHP, Vale, and Rio Tinto, all completed the sale of iron ore on the blockchain to Chinese companies.

Singaporean banks are also involved in such transactions. Singapore also hosts partners that have been testing blockchain transactions with Russia's Sberbank. Technology can lead to all kinds of new payment channels.

Adding governments, reputable institutions to the mix to create regional multi-currency stable coins, which means creating regional Bancors for international trade, could potentially use the same technology on a larger scale.

Right in the US, Facebook and many other members of the market have established the Libra association (now renamed Diem).

The initial capital contribution for each member is 10 million USD with 100 members. The association’s expansion or contraction is decided by the association to keep the stable value of Libra/Diem.

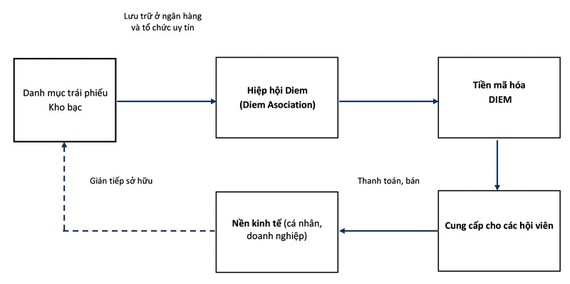

The number of newly issued Diem cryptocurrencies is backed by a basket of low-volatility tangible assets, which are Treasury bonds of some major countries such as the US, EU, UK, Japan,… stored in banks and reputable organizations to guarantee the value of Diem.

It is quite similar to the previous gold standard, but nature operates on the need to hold a portfolio of Treasuries to stabilize the value of Diem. At the same time, this monetary system works to decentralize the transaction, not the creation of money.

Therefore, the role of creating nominal money remains with the central bank. In addition to the system’s benefits, the digital currency transaction function also helps change the way fiat money is held for global commercial payments.

With this monetary system, individuals and businesses hold Diem as holdings of portfolios secured by the governments’ debts. But because of the laws and regulations in each country to protect their fiat currency limit or forbid an individual, businesses can use the money to invest in Treasury bonds.

Diem's operating model will change the way this asset is held. At the same time, keeping these assets is used as a means of payment and a store of value such as an investment.

Now, in the financial market, some new buyers are individual and corporate investors in addition to the traditional members mentioned above. The problem now is that each country's government will ban its citizens from using another country's currency but whether it is possible to ban the holding of Diem when the system is decentralized?

What happens when the country can use Diem to pay each other outside the global/regional currency function? Each country will have to change its policy to combat goldification, dollarization and now Diemization.

Potential assessment - Personal opinion

The future development potential of the Diem cryptocurrency is enormous for five reasons.

Firstly, the community of members belonging to the Diem association are leading organizations in many fields and can apply cryptocurrency directly in their area toprovide a concrete first step towards attracting more organizations to the Diem Blockchain network.

These organizations also lobby for relationships that help connect Diem with major central banks around the globe.

Second, Diem uses blockchain to ensure safety, transaction security and cost savings for users.

Third, Diem has its programming language attached to the open-source Diem Blockchain to help programmers and developers create applications based on smart contracts easily.

Fourth, Diem is backed by stable assets with low volatility, helping to reduce exchange rate risk; differentiates Diem from traditional cryptocurrencies.

Fifth, the large Facebook user community creates an extensive user network from the beginning for Diem.

Although Diem has many positive sides and promises to become the expected cryptocurrency in the crypto community, many problems are still to be encountered.Diem is only at the beginning.

Indeed we can see, Diem will be able to make the world a better place by decentralizing transactions, technology platforms and bringing countless other benefits to users with affordable fees.

However, whether Diem can go to the final goal or not, it is a long story. Even so, all actors in the economy and governments need to prepare a scenario for the success of Diem or another accepted cryptocurrency that will change the way the world operates at the moment.

Author: Dr. Le Dat Chi and research team, School of Finance, University of Economics Ho Chi Minh City

.jpg)